Mike Hassaballa, HH Angus’ Lead Consultant on Energy Infrastructure, summarizes the ‘need to know’ about Ontario’s current electricity market reform.

May 1, 2025 wasn’t just a date on IESO’s calendar. It marked the start of Ontario’s boldest electricity market reform since 2002, a full system reboot designed to fix inefficiencies that have quietly cost ratepayers hundreds of millions of dollars per year.

If you’re an energy engineer, building owner, electricity generator, distributed energy resources (DER) developer, or anyone whose business touches the grid, this is the moment to pay attention - the playing field is shifting under our feet.

Why Reform? Because the Old System Was Broken

Since its inception, Ontario’s market has used a “two-schedule” system: one engine for dispatch, another for price. It’s like driving with one GPS for the map and another for fuel costs - they never aligned. That disconnect forced Ontario to pay ~$100 million annually in Congestion Management Settlement Credits (CMSC), a patch to make up for pricing that didn’t reflect grid realities. Even worse, these payments created gaming opportunities and buried congestion costs in opaque adjustments.

CHP - Combined Heat and Power

DAM - Day-Ahead Market

DER - Distributed Energy Resources

CMSC - Congestion Management Settlement Credits

HOEP - Hourly Ontario Energy Price

LMP - Locational Marginal Pricing

MRP - Market Renewal Program

IESO - Independent Energy System Operator

NYISO - New York Independent System Operator

OZP - Ontario Zonal Price

ERUC - Enhanced Real-Time Unit Commitment

PJM - Pennsylvania-New Jersey-Maryland Interconnection

PPAs - Power Purchase Agreements

PRL - Price Responsive Load

SSM - Single Schedule Market

What’s Changing?

The Market Renewal Program (MRP) replaces this duct-taped design with a cleaner, more efficient architecture, centered around:

- Single Schedule Market (SSM): No more separate pricing and dispatch. Now, dispatch decisions and locational prices are produced in a single algorithm that respects transmission limits. This ends routine CMSC payouts. Other side payment mechanisms will be retained but with significant modifications that address inefficiencies.

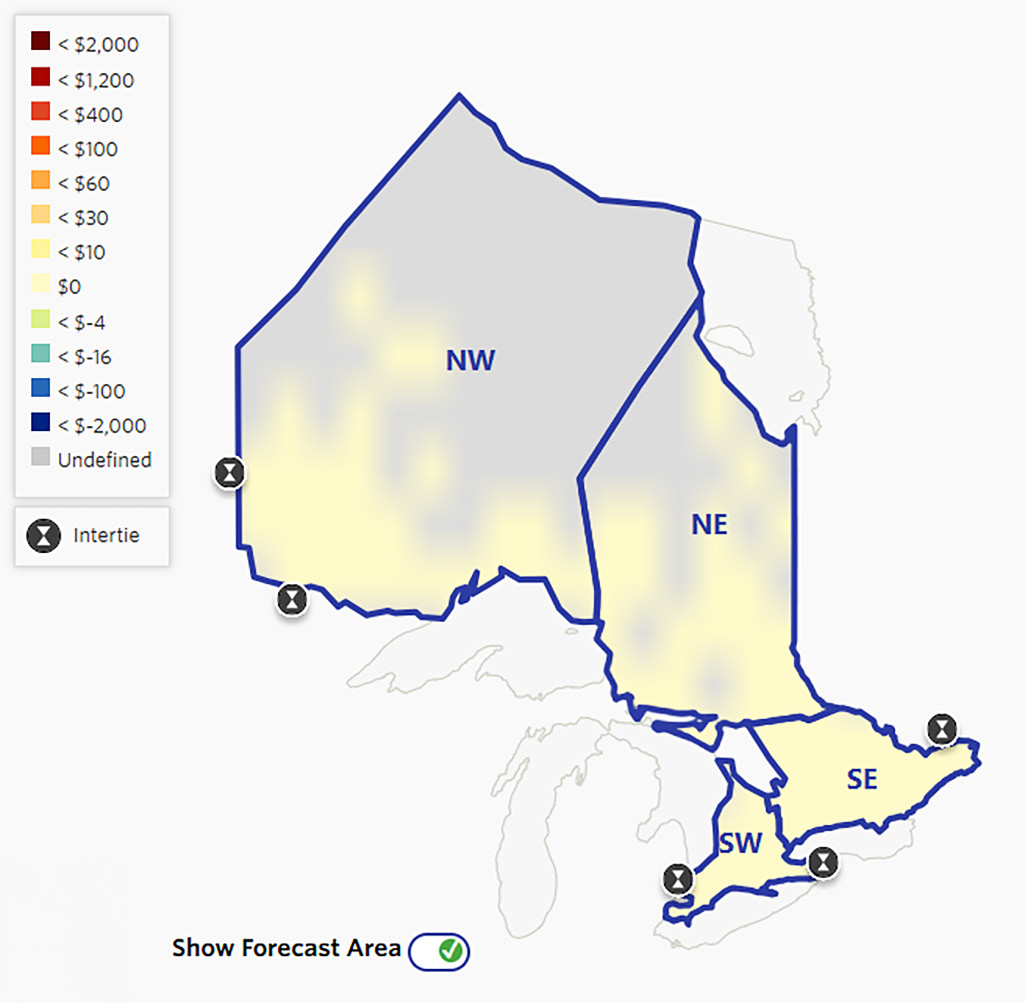

- Locational Marginal Pricing (LMP): Every node on the grid gets its own price. Electricity now costs more where the grid is tight and less where it’s plentiful. Think of it as price transparency with surgical precision.

- Day-Ahead Market (DAM): Ontario’s first real forward market. You can now buy/sell electricity a day in advance at locked-in prices. Generators gain certainty, flexible loads and DERs get new revenue tools.

Together, these form the backbone of a smarter, more transparent, and more disciplined electricity marketplace.

What Does This Mean for You? Let’s Break It Down.

Building Owners & Facility Operators

- Your energy strategy just got more powerful and more complex.

- With DAM and LMP, there are real savings in shifting load or using storage strategically.

- Demand Response can be now financially binding. Flexible HVAC, batteries, and thermal storage? Time to monetize!

New Risks, Bigger Rewards

If you’re a Class A customer or run a large energy portfolio, Ontario’s Market Renewal Program isn’t just noise in the background - it’s a new cost structure with real cashflow consequences. And if you know how to play it? You can win.

Goodbye Hourly Ontario Energy Price - Hello Locational Pricing

Your old HOEP-indexed strategies are now out of date. Under MRP:

- You’ll settle energy at the Ontario Zonal Price (OZP) or possibly at your local LMP if you’re a dispatchable load.

- If you’re in a high-demand, import-constrained zone (e.g., Greater Toronto Area or Ottawa), expect higher average prices.

- If you’re in a surplus or export-constrained zone, you might benefit from lower wholesale prices. What this means: location-based cost volatility is now a real factor in your energy bill.

Day-Ahead Market = New Procurement Strategy

The new DAM is a two-settlement system. For savvy operators, this is a big win:

- You can lock in prices a day in advance, smoothing your cost curves and budgeting with more confidence.

- If you operate flexible loads, you can bid reductions into the DAM (via Price Responsive Load or demand response mechanisms) and get paid to not consume.

- You can hedge LMP exposure more precisely using DAM data and new tools from energy retailers.

This isn’t theory. It’s a new market you can play in, every single day.

Time to Update

Your Playbook

This is not business as usual. You’ll need to:

- Map your site’s LMP exposure.

- Evaluate procurement strategy changes fixed vs index, DAM participation, retailer contracts.

- Explore whether PRL registration makes sense (yes, it requires telemetry and some effort, but the economics may justify it).

- Work with consultants and energy advisors who understand basis risk, nodal dynamics, and two-settlement optimization.

Risks If You Sit Still

- Prices will spike in some areas. If you can’t respond or hedge, you’re exposed.

- Retailers will pass through these costs, maybe with a delay, maybe with a markup.

- This is no longer a passive procurement game.

Bottom line: You’ve been given tools, don’t leave them in the box.

Generators and

Developers

- Location matters more than ever. A generator in a congested zone could see higher returns. In surplus zones? Brace for negative prices.

- The end of CMSC means no more side-payments. You either make money or you don’t.

- DAM and Enhanced Real-Time Unit Commitment (ERUC) help you manage risk and fuel costs better, but you’ll need sharper bidding strategies.

The Market Just Got Smarter;

Your Project Model Should Too

For developers building the next wave of Ontario’s energy infrastructure solar, battery, CHP, or hybrid systems MRP isn’t background noise. It’s the new rulebook for how you’ll make money (or not) on future assets. This market reset directly affects siting decisions, financial models, and bankability.

Location is No Longer Just About Interconnection

With Locational Marginal Pricing, every project will earn based on its nodal value. That means:

- A battery in a congested urban zone could make 3–4X more on arbitrage than one in a low-price surplus zone.

- A CHP unit near a load pocket might earn premium capacity value, while the same asset in a hydro-rich region faces rock-bottom LMPs.

If your site selection doesn’t model nodal prices, you’re already behind.

The Day-Ahead Market

= Revenue Certainty

Ontario finally has a real DAM. For developers, this changes the game:

- You can lock in prices before real-time volatility hits.

- You can offer flexible assets (e.g. batteries, demand response portfolios) into the DAM and earn guaranteed revenue.

- You can better structure merchant revenue models without relying entirely on fixed contracts or PPAs.

- For the first time, Ontario supports a merchant style pathway that looks more like NYISO or PJM.

LMP = Real Investment Signal

Persistent price separation across zones will now show:

- Where to build new supply

- Where storage earns best arbitrage margins

- Where demand response or DER aggregation can fill a local gap

This means you don’t have to rely on opaque planning reports or uplift data anymore the market will show you where you’re needed. And for large-scale infrastructure (transmission-connected projects, utility-scale batteries), this clarity can make the difference between bankable and borderline.

The Complexity is Real

- You’ll need to model nodal revenue, not just average price curves.

- Intertie projects and exporters must now navigate DAM pricing at the border node which can vary substantially.

- MRP introduces Market Power Mitigation, Make- Whole Payments, and two-settlement accounting. That’s a lot of financial logic to wrap into your pro forma.

Your financial model still assumes a fixed HOEP or simple real-time average? Time to hit delete.

Bottom line: Given the rules just changed, developers who understand nodal pricing, DAM strategy, and basis risk will capture upside. Those who don’t may build stranded assets.

DER Operators

- Batteries, solar, and CHP all gain better market access.

- Arbitrage opportunities multiply under LMP and DAM.

- Sophistication is required: small players may need aggregators or software to navigate the complexity.

If you own or operate DERs batteries, CHP, rooftop solar, or aggregated HVAC systems, the MRP is a paradigm shift. We’re moving from a world of flat prices and opaque value streams to a market where location and flexibility directly determine your revenue.

The Big Shift is From Uniform Pricing to Granular Value

Under the old HOEP system, a solar installation in a congested downtown node earned the same as one in a remote surplus region. That’s over.

Now with Locational Marginal Pricing, a battery in a Toronto high-rise during peak hours might see $200/ MWh prices, while a wind farm in the Northwest gets a negative LMP during surplus. If you’re not thinking in nodal terms, your revenue models will be wrong.

Day-Ahead Market = Better Tools, More Certainty

The DAM is a gift to flexible DERs:

- You can now bid in expected production or curtailment in advance.

- If you lock in a day-ahead price, you know your value before real-time volatility hits.

- Aggregators can offer portfolios of DERs HVAC controls, batteries, or EV fleets into the DAM and get paid for reliability.

This turns DERs into serious market players. You’re not just shaving peaks - you’re offering dispatchable, schedulable services.

Price Volatility = Arbitrage Playground

MRP introduces real volatility in both time and space. For smart DER operators, that’s not a risk - it’s a playground:

- Charge your battery when LMPs dip (e.g., midday solar oversupply).

- Discharge when your node spikes (e.g., during constrained peaks in urban zones).

- Bid demand response or CHP output into the DAM for guaranteed returns.

The IESO Is Watching

The IESO wants DERs in the market. Parallel initiatives (DER Market Integration, telemetry standards, aggregation rules) are evolving fast. But onboarding is still a barrier especially for small players.

If your business model relied on net-metering or fixed feed-in contracts, it’s time to model LMP exposure and DAM participation seriously.

Flexibility is now bankable. But a warning: this Isn’t Plug-and-Play anymore.

- MRP is complex bidding, settlement, nodal forecasts, market power mitigation rules.

- DERs will need forecasting, optimization, and compliance tools.

- Many will rely on aggregators or retail partners to handle the backend.

And here’s the twist: inflexible DERs (e.g., standalone solar in surplus regions) could see low or negative prices during off-peak hours. Without storage or curtailment capability, they might be paid little or even be penalized.

Who Loses?

- Passive participants - those used to fixed prices, predictable CMSC payouts, or set-it-and-forget-it operations will struggle.

- Projects in surplus regions (especially non-dispatchable renewables) may see lower spot revenue.

- Retailers and LDCs will need to rethink

procurement and risk exposure.

Strategic Takeaway

This isn’t just an IT system upgrade, it’s a complete behavioral reset for Ontario’s electricity sector. The old rules rewarded predictability. The new rules reward flexibility, location, and foresight.

My Final Thoughts

MRP is not perfect. It’s complex, introduces volatility, and demands a steeper learning curve. But it is built on reasonable ideas, and it opens the door for smart energy users and innovators to thrive.

Whether you’re bidding into the DAM, optimizing building loads, or developing the next battery project, your next move should assume MRP is the new normal.

Please reach out if you have insights or would like to discuss facilities needs.

Mike Hassaballa, M.A.Sc., P.Eng

Lead Consultant, Energy Infrastructure, Senior Engineer